Added to that is the question of 'If I save now, when can I start living?' and the extra bit that baffles older generations, some millennials don't want to buy a house.

While every dollar you save will make a difference, and daily lattes and smashed avocados can really add up over time the big hit to your wallet in your 20's is travel. Especially those ridiculous Contiki tours that bundle you up in a bus with a group of people just like you - middle class 20-somethings with disposable income. Not only are they far more expensive than DIY-ing your holiday, they also insulate you from really experiencing the culture of a place.

Rather than wrapping yourself up in the expensive cotton wool of a Euro-trip (did people have this obsession with Euro-trips before that movie?) consider starting slower, getting your teeth into travelling and bulking up your wallet at the same time.

The big Euro-trip, what does it cost you?

Let's start by assuming you have a full-time job and can get four weeks of annual leave each year. You're going to spend 18 - 24 months saving for and planning two big overseas trips over the next four years, plus a few little holidays around home to use up the rest of your annual leave (say, taking a few days over Christmas and Easter to visit family).Over four years, let's say you go on two trips, here's a rough cost breakdown, with links to where I pulled the prices from. I've set everything at 'mid-range' for hotels and food. If you look closely you'll see I haven't included entertainment costs outside the Contiki tours, this is just the costs to get you there and get you around - you still have to add tours and attractions onto it.

In America I've given you a car. In Europe I've given you a global rail pass that will get you anywhere you want. In both cases I'm sending you on a Contiki tour because that seems to be the rage amongst my travelling friends.

Obviously you could do these trips cheaper by backpacking and cooking your own meals.

28 days in the United States

| Flights in and out of LAX | ||

| July – Aug 2017 | $1,300 | |

| March – April 2018 | $1,660 | |

| Average cost | $1,480 | |

| 11-day Contiki Tour | $2,498 | http://tours.statravel.com.au//trip/la-to-the-bay-cowwaf? |

| Tour inclusions | 10 Nights Accoms 7 Breakfasts 5 Dinners | |

| Pay for your own… | ||

| 4 Breakfasts | $30 | |

| 6 Dinners | $150 | |

| 11 Lunches | $110 | http://traveltips.usatoday.com/figure-out-much-spend-per-day-traveling-103634.html |

| Souvenirs | $100 | |

| Boozy Times | $200 | I’m told people drink a lot of cocktails on Contiki Tours |

| 17 Days non-Contiki | ||

| Car Hire ($40 p/day) | $680 | |

| Mid-range hotel ($130 a night) | $2210 | http://www.lonelyplanet.com/usa/money-costs |

| Three meals a day ($55) | $935 | http://www.budgetyourtrip.com/united-states-of-america |

| America Total | $8,393 |

28 days in the Western Europe

| Flights into London, out of Rome | ||

| July – Aug 2017 | $1,534 | |

| March – April 2018 | $1,307 | |

| Average cost | $1,420.50 | |

| 16-day Contiki Tour | $2,875 | http://tours.statravel.com.au/trip/London_to_Rome-COCCLR |

| Tour inclusions | 15 Nights Accoms 15 Breakfasts 11 Dinners 1 Lunch | |

| Pay for your own… | ||

| 4 Dinners | $120 | |

| 14 Lunches | $315 | http://www.nomadicmatt.com/travel-blogs/the-cost-of-traveling-western-europe/ |

| Souvenirs | $100 | |

| Boozy Times | $250 | I’m told people drink a lot of cocktails on Contiki Tours |

| 12 Days non-Contiki | ||

| Eurail Global Pass | $856 | |

| Mid-range hotel ($80 a night) | $960 | http://www.lonelyplanet.com/usa/money-costs |

| Three meals a day ($65) | $780 | http://www.budgetyourtrip.com/united-states-of-america |

| Europe Total | $7,676.50 |

So - in four years if we start with our BIG overseas trips, we're going to make some wonderful memories, but we'll be out of pocket just over $16,000. And due to the big price tags we only get to travel twice in four years.

Start small, build it up

Okay, so that was pricey, what if you were to try the not-very-far travel plan?Step One: Be a tourist in your own backyard

For your first year of travelling, don't travel! Head down to your local tourist information point and find out what is going on at home. Plan some day-trips, some weekend getaways and use up a few of your annual leave days for extra long weekends. You can use those annual leave days to turn a regular long weekends into even longer ones, or to take a three-day weekend where everyone else is back at work on a Monday.Ask around your friends and see if anyone has a holiday home, or a tent they can lend you. Try all kinds of holidaying - go camping somewhere without a shower, hire a top class house on the foreshore via AirBnB (referral link, $50 credit when you sign up), visit your friends 'shack' near the river. Now is the time to find out what kind of accommodations you like, whether staying in a five-star room is necessary for you, or if you can have a good time sleeping in the back of a van.

Check out all your local attractions too. There are people paying to fly to wherever you are - I live in a sleepy town that bands regularly skip over because we are just too boring. But checking out our tourism website gives me enough to do for months. Largely food related, we have berry picking, world class wineries and farms your can visit and pet the animals and buy products. We also have beautiful walking trails, a variety of museums and a cool obscure attractions like paintball and an archery adventure trail.

Prices vary but taking camping as an example:

- Tent, sleeping bags and a couple of camping chairs - $300 - 500 (I had this chair, not cheap but super comfy, especially on cold nights.

- Firewood (necessary!) - $50

- Food - $20-30 per person, per day - take junk food, it's a holiday. If your budget can stretch it get a cast iron camp oven. Otherwise use a propane stove and your regular kitchen pots and pans.

- Camp fees - $5-15 per night or keep an eye out for free sites.

Staying at a friends cabin / shack / holiday home will be free or dirt cheap. Staying at an AirBnB will vary depend on your preferences.

Add in a few trips to some local attractions (let's say $50 each once a month) and two or three overnights, we can have our first year of non-travel for less than $1,500 and most of that cost is buying camping gear.

Step Two: Cross the country, but no international waters

I fly around the country three or four times a year for roller derby. It's expensive and exhausting, but has taught me that if you look out for flight sales, play the credit card rewards game and take the airport bus, you can get a great holiday on the cheap. And think, you've just spent a whole year being a tourist in your own town - now we're opening up the whole country! With the right timing on flights you can get anywhere in Australia for under $100 a flight.Accommodations are available from under $40 a night. Score a room with a toaster or a kettle and you can do breakfasts in your room to keep the costs down under $2. I often get cheap lunches when traveling for derby by ordering the entree (seriously, $11 for four mammoth arancini balls! Divine and super filling). If you're traveling with a friend pub meals often come in two sizes - big, and too big. Order the 'too big' serve and split it.

Even allowing a few nights of splashing out, you should be able to eat on under $35 a day - and that includes a daily latte. Also consider mixing up free tours and paid attractions to keep the costs down.

In your second year of not traveling far consider a taking just one three or four-week trip. With $200 for flights and $100 a day for accommodations, meals and attractions you should make it through the year on less than $3,000 ($100 times 28days, plus $200 of flights).

Mr. FIRE and I spent almost a month in Tasmania in a camper van for just under $4,000. We mostly ate food we cooked and did a hell of a lot of hiking. We also hit up tonnes of attractions and ate a few absolutely mouth-watering restaurant meals. By prepping most of our food ourselves we saved a tonne and could really splash out when we did go out for food. We also had no shortage of wine.

Step Three: Travel to the cheap places, on the cheap

If you've mastered shopping for cheap flights and using travel rewards, it won't actually cost you much more to travel overseas than locally. This is because you can visit countries that have a lower cost of living and stretch your dollar further. But you should travel locally first so you get the hang of packing and dealing with flights before you're in a foreign country.Give yourself $4,500 for this years travel. Sneak in a few overnight getaways with that camping gear you bought, and at your friends holiday houses you learned about in your first year. Maybe do a road-trip inside your own country to a place you didn't make it to last year. Either way use what you've learned previously to spend $1,500 in this country and leave $3,000 to go overseas.

What can you get overseas with $3,000? $777 will get you a round trip to Phuket leaving in two weeks time. You can travel on the cheap for $50 a day, eat the street food (go where the locals go) visit temples, go snorkeling and check out the night markets. If you want a luxury experience you can get an hour massage for a measly $7. For $777 flights and $50 a day you can travel for over six weeks.

Not keen on Phuket? Indonesia, Cambodia, parts of South America and India are all cheaper than Australia. Get crafty with your flights and away you go!

Step Four: You've made it! Check out Europe

Okay, you've got three years of travel experience up your sleeve. Time to go on that big Euro-trip you wanted back at the start. Except now you are practiced at flying overseas, at managing the food budget, at not losing your luggage, at waving your arms and trying to be understood in another language. Now go on that big Euro-trip, but use your wisdom to do it for cheaper day-by-day, and stay longer.Final cost - $6,000 instead of the previous $8,000 - because you're not going on that crazy Contiki tour anymore, right?

Dollar for dollar, how does it stack up?

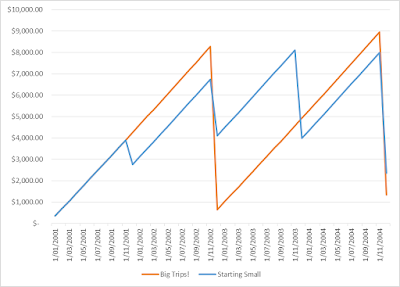

In my slow version, you'll spend $15,000 over four years with two international holidays, one holiday in your own country and at least three weekend getaways a year. If you go for the two big trips you spend $16,000 over four years and you don't have the spare funds in your budget for those weekend getaways. Plus since you've never traveled before you probably lose your luggage or forget to pack something important.So let's say both our travelers save $350 a month, check out what their finances look like...

A bit boring at this stage - there's no real difference at the end of four years, although our 'start small' traveler is up $1,000 that's just the difference in their spending. But if we do the same thing again for another four years...

Our start-small traveler is now ahead $2,200, they've seen Europe and America, as well as Phuket and Bali, they've found some amazing local pubs and garden mazes in their own town and they've traveled around their own country as well. By starting smaller they've not only traveled better, but they've traveled cheaper. They also have their money working for them through compound interest as it sits in their account helping them save.