I've been slowly trying out the world of travel hacking. I started last year with a small, not fee credit card and scored 10,000 Velocity points. Now I'm juggling three credit cards, with an expected return of more than 230% value.

Wait, what is travel hacking?

Travel hacking is (very basically) leveraging rewards programs to travel on the cheap. Many credit cards will offer massive sign-up bonuses that will generally pay for a flight or two, maybe some hotel reservations. Travel hacking deserves an entire blog or three to itself, which I promise to work on writing later. In the meantime, check out the related links at the end of this post.

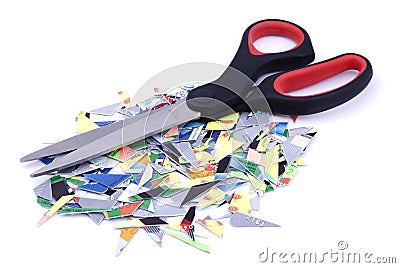

For now, the short summary is Open a credit card, meet the minimum spend for bonus points, shred the card. Rinse and repeat. There's some important rules around how opening cards affects your credit score, and figuring out if annual fees are worth the cost, but I'll cover that another time.

For now, the short summary is Open a credit card, meet the minimum spend for bonus points, shred the card. Rinse and repeat. There's some important rules around how opening cards affects your credit score, and figuring out if annual fees are worth the cost, but I'll cover that another time.

Aren't credit cards the devil?

Let me be really blunt. If you don't have 110% control over your spending you do not have a credit card. Period. No questions, not wiggle room. Credit Cards are dangerous. They are like fire, really nice to look at, kinda warm and comforting, and a raging destructive blaze waiting to happen if you take your eyes off them. A carefully managed campfire is a nice place to sit around, cooks your food, provides a little bit of light in a dark place. But if you try and build up a big bonfire because it's super pretty, you are going to quickly run out of fuel. Even worse you might lose control and set the whole campsite alight, doing hundreds and thousands of dollars damage.

That's definitely not an exaggeration. I put a month worth of bills on my credit card, and the statement came back to say if I made minimum payments I would spend $5,908 and take 39 years to pay off the card. That was just using the card lightly for monthly bills. If I had maxed it out the card it would cost me $55,000 over 50 years at minimum repayments.

Of course, if I pay off the card in full each month, I only pay for the things I bought. As it should be. It also means that I get to leave the money in my offset account for a few extra days. $1,000 in my offset account saves $3 a month. It might be a small amount, but it knocks $1,000 and a month off my overall loan costs. Just by moving money around in smart ways I 'made' $1,000.

So, credit cards are not the devil if you pay them off in full, every month. If you have even a snifter of worry about making the payment, do not open the card. Credit cards are not a magic tool to delay payments till after payday, that's just a way into unending strife.

And you don't buy shoes with them...

So why did you shred one?

I'm also attempting to delve a bit deeper into property investment. At this stage I have a amazing credit score, according to Credit Savvy, which is a free site to check your credit score. As a free site I worry that it's not doing the deepest search, but as it's returning a credit score of over 900 I'm not worried too much. Even a 20% variance in that score would still leave me sitting over 700.

So while I'm not concerned about the hit to my credit score from opening and closing cards (yet), I do need to watch the amount of debt that I'm carrying. When you apply for a mortgage, banks will assume that you are going to use all the credit available to you. If you have $25,000+ of available credit the banks will assume that you are going to use it all when calculating if you can manage the repayments of the mortgage. While you might be someone who pays off your card in full every month, the banks always consider the worst case when considering if they want to offer you a loan.

So by closing a card, I might take a bit of a hit to my credit score, but I also lower my 'risk' in the banks eyes by having less credit available.

So by closing a card, I might take a bit of a hit to my credit score, but I also lower my 'risk' in the banks eyes by having less credit available.

Okay, so how does this work out to 230% return?

I've only opened one card with an annual fee, so I'm counting the 230% on that card alone. My BankSA Platinum card has charged me a $99 annual fee. Once I have spent $2,500 they will pay a bonus 30,000 Qantas Frequent Flyer points to my account. Those 30,000 points translate to roughly $230 worth of flights. $230 / $99 = 232%. Once I have those bonus points applied to my account I'll set the card aside and look for another opportunity. When the card is a few months old I will close it, so I'm not going to pay the annual fee again. Keeping the card open for longer will mean less impact on my credit score long term.

It's important to crunch those numbers before you start though. The cheaper Bank SA card offers 10,000 points for $79 fee, which only gives you about $76 worth of flight, and then the more expensive card is 30,000 points, but a a crazy $279 fee! That works out to $230 of flights, that you paid $279 for. Bzzt, no thanks. They do offer some fancy things like a 10% bonus on points earned on your birthday, and two lounge passes which might be valuable enough for you, but they don't cut it for me.

On top of that one card, I also have two others that are fee free that have made me 50,000 Altitude Rewards points, and 20,000 Velocity Frequent Flyer points. Hopefully between all these points I'll be able to take a couple of short trips around the country for free (or at least super cheap!) this year.

Oh, and all the 'money' that I make through these points is completely tax free. 50,000 points is equal to about $230. If I had earned $230 at work I would have been slugged $75 in taxes for it.

In a nutshell, credit cards are designed by banks to make them money. They throw in all kinds of crazy offerings to try and get you to sign up in the hopes that you will make a mistake somewhere and end up paying exorbitant amounts of money to them. But if you carefully game the system, you can come out ahead.

It's important to crunch those numbers before you start though. The cheaper Bank SA card offers 10,000 points for $79 fee, which only gives you about $76 worth of flight, and then the more expensive card is 30,000 points, but a a crazy $279 fee! That works out to $230 of flights, that you paid $279 for. Bzzt, no thanks. They do offer some fancy things like a 10% bonus on points earned on your birthday, and two lounge passes which might be valuable enough for you, but they don't cut it for me.

On top of that one card, I also have two others that are fee free that have made me 50,000 Altitude Rewards points, and 20,000 Velocity Frequent Flyer points. Hopefully between all these points I'll be able to take a couple of short trips around the country for free (or at least super cheap!) this year.

Oh, and all the 'money' that I make through these points is completely tax free. 50,000 points is equal to about $230. If I had earned $230 at work I would have been slugged $75 in taxes for it.

In a nutshell, credit cards are designed by banks to make them money. They throw in all kinds of crazy offerings to try and get you to sign up in the hopes that you will make a mistake somewhere and end up paying exorbitant amounts of money to them. But if you carefully game the system, you can come out ahead.

Related links

Travel hacking sites to kick-start your journey:

- Points Hack - Australian

- Travel Miles 101 - American

No comments:

Post a Comment