November was utterly consumed with this adorable little rugrat. We went through so much in the first month. Sleepless nights, constant supervision, and endless amounts of car vomit. Whether it was our good parenting, or sheer dumb luck, we didn't have to deal with things being chewed on or any major housebreaking accidents.

We do still have a whole 'nother round of teething to get through, so it's entirely possible my next round of expensive spending will be replacing the things her new teeth found. Stay tuned..,

Goals For 2020

Goal #1: 50% Savings

I have a confession to make: I'm a FIRE blogger and my savings rate sucks.

At the end of The Year of Investing in 2018, my savings rate was sitting comfortably at 55%. At the start of 2020, it was a weenie 35%.

Getting my 3-year average savings rate to 50% is going to be next to impossible, but I'm going to track it for interest. The actual goal is for this 12 month period to sit comfortably above 50%.

November Rate: 33%

2020 Average: 30%

Three-Year Average: 34%

Thanks mostly to the car purchase, inspired by the puppy purchase, this year has been pretty flat. My three year average has gone from 35% to 34%, which is of course the opposite of what we were aiming for. Part of me is disappointed, but a bigger part of me knows I made a huge life change that I'm very happy with, and survived a pandemic - so I can't be too disappointed.

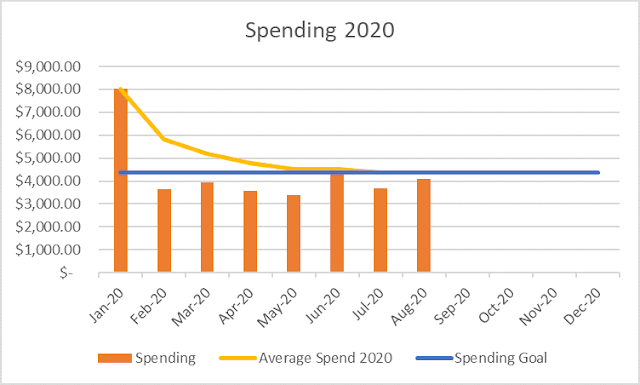

Goal #2 Reduce Average Spending by 10%

Having two investments has gotten expensive, and my spending has been creep-creep-creeping. From an average $3,500 spending back in 2018, now I'm sitting at $4,800 at the start of 2020.

November Spend: $3,580.17

2020 Average Spend: $5,022.75

2020 Average Spend: $5,022.75

Goal Spend: $4,378.30 (or less)

Still above the desired average thanks largely to the car purchase, but otherwise looking good. Without the car we'd still be slightly over ($4,386.39)

Spending

Here's what I spent in November, which includes the save-to-spend amounts and a new category for the car.

Category | Spent | Budgeted | 12 Month Average |

|---|---|---|---|

| Home | $700 | $954.17 | $952.59 (no change) |

| Under Budget. Just the rent this month. | |||

| Investment Property 1 | $1,100 | $1,145.83 | $1,222.38 (up $35.50) |

| Under Budget. The mortgage and the water bill, plus $110 set aside for later. | |||

| Home turned IP2 | $750 | $833.33 | $1,085.30 (up $11.49) |

| Under Budget. The mortgage, plus $190 for later needs. | |||

| Personal Bills | $130.74 | $130.83 | $127.84 (up $0.29) |

| Under Budget. Health insurance went up | |||

| Groceries | $343.52 | $200 | $199.30 (up $8.54) |

| Over Budget. Nothing special happened here.. I was just hungry 😁 | |||

| Pets | $325.52 | $150 | $231.75 (up $33.72) |

| Over Budget. Puppy preschool, flea and worm treatments, vaccinations... puppies are expensive! But from December things should start settling down. | |||

| Roller Derby | $90.75 | $166.67 | $173.67 (down $2.44) |

| Under Budget. Just some drinks with friends, and a bit of saving for new gear. | |||

| Travelling | $50 | $105 | $33.33 (up $4.16) |

| Under Budget. Just putting aside money for the future | |||

| Comfort Food | $0 | $50 | $32.94 (down $8.13) |

| Under Budget. I probably could shift some of the grocery spend here, if I'd thought about it. | |||

| Car | $34.64 | $200 | $638.25 (up $2.89) $635.36 |

| Under Budget. After six weeks I finally needed a tank of petrol. Car usage will increase when my puppy is old enough to go hiking and gets over being car sick. | |||

| Donations | $5 | $92.92 (up $0.42) | |

| None | |||

| Other | $50 | $183.33 | $256.29 (down $36.95) |

| Under Budget. All saving for future spend. Puppy is still taking over my life. | |||

| Total | $3,580.17 | $4,119.17 | $5,046.56 (up $49.48) |

| Total ex. Donations | $3,575.17 | $4,953.65 (up $49.07) | |

| Under Budget. It was nice to come in under budget considering pup consumed my life, and my wallet (figuratively). You can tell she kept me on my toes because this post isn't out until December is basically over.. woops! | |||

The days are getting longer and it's pretty wonderful. We even got to go camping at the end of the month

The days are getting longer and it's pretty wonderful. We even got to go camping at the end of the month

Happy August everyone. The weather is picking up, and so is life.

Happy August everyone. The weather is picking up, and so is life.

Happy Financial New Year (how many times can I make that joke? As many as I like!)

Happy Financial New Year (how many times can I make that joke? As many as I like!)

Happy Pandemic month. It's been very bland

Happy Pandemic month. It's been very bland

I'm FIRE'd! Aprils Fools... I'm not FIRE'd or fired, just working from home forever.

I'm FIRE'd! Aprils Fools... I'm not FIRE'd or fired, just working from home forever.