In December we get paid bonuses and atone for what we spent in November.

December was a weird emotional yo-yo of a month. I went through that end of year intense desire to change my life, and then on New Years Day crawled into a depressed bubble about how nothing good ever happens. Even though I went to therapy, and made new friends, and did great at my job, wrapping up the year with a busted leg really put a downer on the whole thing. It's been a struggle because I feel like I can't do a lot of things, that makes me want to do less things, which means I feel less like doing things, and so on, and spiralling forth.

However, this blog is about money, and financially speaking December was also a weird yo-yo month. I got paid my end of year bonus and got my annual payrise, both of which were the highest amount I was able to earn. That said, my graphs below are going to show that I haven't done well on the whole this year, and I'm largely putting it down to 'save money' as being the type of goal that really doesn't motivate me.

Instead, in 2022 I'm going to try out two new goals - one is a rehash of the old 'Year of Investing' with signficantly loftier goals. The other is going to be a year of buying Nothing New in 2022. I'll write a more detailed post on it in the coming days and weeks, but in a nutshell, nothing new (except perishables, hygiene and safety products), instead I'll aim to thrift, make, and trade for things. Where I do buy new, I'll be aiming to only do it after a solid effort at finding second hand.

In preparation for next year I made a couple of steps: I cancelled my dogs monthly treat box, cancelled my gym membership and started refinancing my home loans. In defence of the monthly treat box, I was using them all prior to my knee explosion, and I thought they weren't hugely expensive at $7 per 100g. Since my knee injury, I've slowed down on training because I'm just not agile enough - which means I slowed down on treats and now I have two months worth sitting on a shelf.

Similarly, I was going to the gym 3-4 days a week pre-injury, and not at all post injury. When (if) I pick it up again I can use the home supplies. My partner bought a stationary bike for himself, and a friend of ours handed off his weights, so all I need is motivation.

Goals For 2021

The exact same as 2020. I think we all agree to write off 2020.

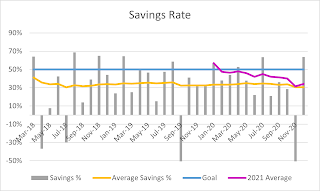

Goal #1: 50% Savings

Yet again, the actual goal is for this 12 month period to sit comfortably above 50%. Ideally, I'd like to bring the 3year rate up as well, but we'll see how that actually goes.

December Rate: 64%

2021 Average: 34%

Three-Year Average: 31%

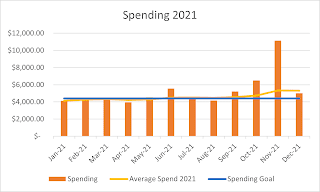

Goal #2 Reduce Average Spending by 10%

The goal is to reduce my average spend by 10% from January 2019 - bringing it down below $4,400 (a nice rounded number).

December Spend: $5,002.26

2021 Average Spend: $5,301.75

2021 Average Spend: $5,301.75

Goal Spend: $4,400 (or less)

Spending

Here's what I spent in December, which includes the save-to-spend amounts.

Category | Spent | Budgeted | 12 Month Average |

|---|---|---|---|

| Home | $1,607.51 | $954.17 | $1,519.48 (up $31.64) |

| Over Budget. The utilities came in, and I'm pretty sick of paying more for power every quarter even though I'm using less. | |||

| Investment Property 1 | $1,050 | $1,050 | $1,215.59 (down $4.17) |

| On Budget. Mortgage and saving for repairs. | |||

| Home turned IP2 | $950 | $950 | $949.60 (up $16.67) |

| On Budget Just the mortgage, and the saving for future repairs/upgrades. | |||

| Personal Bills | $137.10 | $137.50 | $136.04 (up $0.53) |

| Under Budget. Nothing new. | |||

| Groceries | $202.66 | $200 | $191.42 (down $12.59) |

| Under Budget. Nothing hugely exciting. My partner came home one day with ridiculous amounts of Christmas snacks, so I was just left with making a couple of actual meals to fill the gaps of festive banqueting. | |||

| Pets | $350 | $350 | $423.09 (up $1.52) |

| Over Budget. Puppy got a Christmas box of delicious, ethically sourced dried snacks. She took three whole days to work through a piece of dried cow-hide, so I'm going to go ahead and say she enjoyed it. | |||

| Roller Derby | $43.33 | $166.67 | $117.74 (down $4.22) |

| Under Budget. I bought a secret santa gift, and put some money aside for later. | |||

| Travelling | $50 | $105 | $50 (no change) |

| Under Budget. Just putting aside money for the future. | |||

| Comfort Food | $47 | $50 | $31.72 (up $0.59) |

| Under Budget. In this case 'comfort food' means 'delicious snack in Sydney with my work pals'. And some uber eats. | |||

| Car | $378.43 | $200 | $221.83 (down $23.44) |

| Under Budget. Annual Rego :( I took half from my saved amount, and counted half as a new spend. | |||

| Donations | $0 | $15.52 | |

| None. | |||

| Other | $186.23 | $183.33 | $430.06 (up $9.11) |

| Over Budget. A mish-mash of things. I bought three board games, some new winter clothes (why did I do that?) and attended some Christmas lunches. | |||

| Total | $5,002.26 | $4,316.67 | $5,302.08 (up $15.63) |

| Total ex. Donations | $5,002.26 | $5,286.57 (up $15.63) | |

| Over Budget. A pretty chill month considering there was a trip to Sydney, Christmas, New Years and all the heat to wrap up the year. | |||

No comments:

Post a Comment